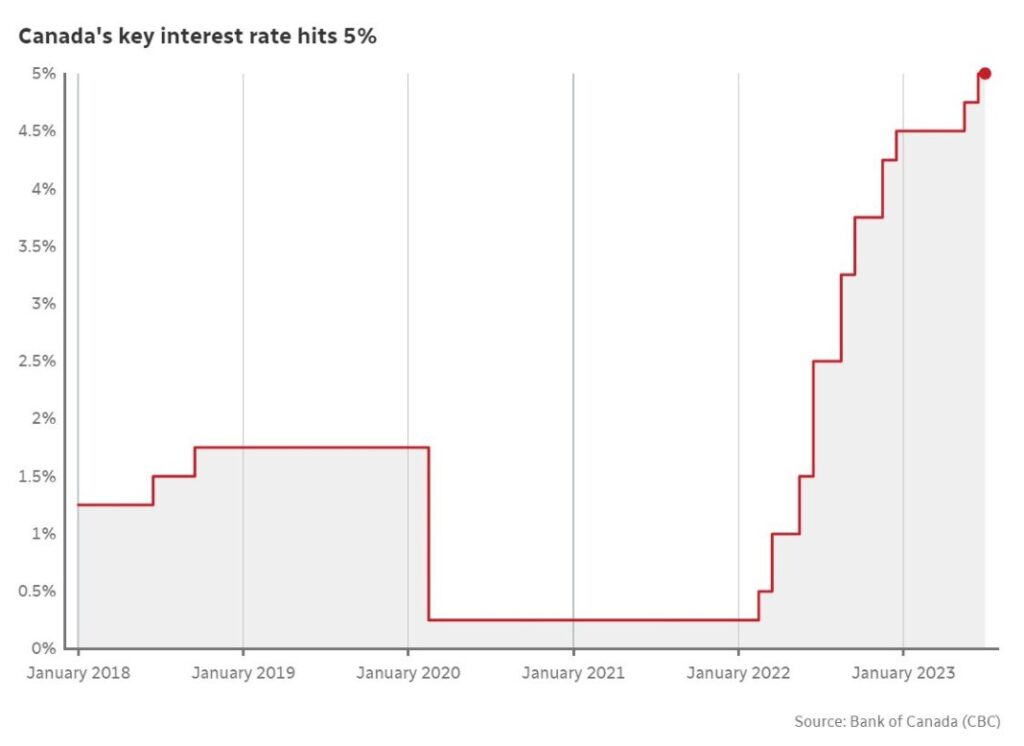

The Bank of Canada has raised its benchmark interest rate by 25 basis points on Wednesday, July 12, reaching the highest level since 2001, due to concerns that declining inflation could stagnate.

The central bank’s key interest rate now stands at 5.0 per cent following back-to-back hikes. As a result, the Prime rate in Canada will rise from 6.95% to 7.2%.

This move was anticipated by economists, considering the resilience of the Canadian economy and the potential for inflation to remain above the central bank’s target of two percent.

The bank expressed worries that a tight labor market and a strong economy could make it challenging to control inflation.

They now expect inflation to hover around three percent for the next year, gradually declining to two percent by mid-2025. June’s inflation rate was 3.4 percent, the lowest since it peaked at 8.1 per cent in June 2022.

The decision on whether to raise rates again after the summer remains uncertain. The tightening cycle has seen the policy rate increase by 4.75 percentage points since March 2022.

The Canadian economy experienced robust GDP growth of 3.1 percent in the first quarter of 2023, primarily fueled by strong household spending on services. In its monetary policy report, The Bank of Canada has revised its expectations for economic growth, projecting GDP growth of 1.5 percent for both the second and third quarters of 2023.

There are divided opinions on the potential for further rate increases in the future.

Mortgage owners beware

The rate hike affects borrowing costs for Canadians, particularly homeowners with mortgages or variable-rate loans tied to the central bank’s benchmark rate.

Homeowners with variable mortgage rates and expiring terms due to renew will be most affected by the rate hike, as it increases the prime rate and requires allocating a larger share of disposable income to debt.

Recent research from the Bank of Canada finds that fixed-mortgage borrowers renewing within the next three years will see an average 25% increase in their mortgage costs.

How much will my mortgage payment increase?

According to Ratehub.ca, a homeowner who put a 10% down payment on a $729,044 home (May 2023 average home price in Canada) with a 5-year variable rate of 5.80% amortized over 25 years (total mortgage amount of: $676,439) has a monthly mortgage payment of $4,248.

With today’s 25-basis point rate increase, the homeowner’s variable mortgage rate will increase to 6.05% and monthly mortgage payment will increase to $4,348, an increase of $100 more per month or $1,200 per year on their mortgage payments.

Factoring in all 10 of the Bank of Canada’s increases in the past year, the total impact on such a borrower would be $1,715 more per month or $20,580 per year on their mortgage payments (a 66% increase).

While mortgage interest rates have contributed to the rising cost of living, grocery prices remain high, though there has been a slowdown in price growth for certain categories. Canadian households and the housing market have shown resilience despite fluctuations.

Coping strategies include opting for shorter-term fixed-rate mortgages and extending amortization periods.

Those with lines of credit and automobile loans will also experience the impact of higher interest rates.

However, with the downward trend in inflation, it is anticipated that the Bank of Canada’s interest rate hikes may soon come to an end, with expectations for inflation and interest rates to soften in 2024.

How will Bank of Canada rate increase announcement impact the housing market?

The Bank of Canada’s announcement of a rate hike is expected to have a significant impact on the housing market.

Despite an earlier uptick in the market, last month’s rate hike led to a decline in transactions, particularly in the Greater Toronto Area (GTA), with a monthly decrease of 16.9%.

Today’s rate hike is likely to further dampen activity as potential buyers assess the impact of ongoing rate volatility on their budgets. Sellers, on the other hand, are expected to remain cautious, resulting in limited inventory.

As a result, home prices are likely to face downward pressure, and transactions are expected to slow down during the summer.